Estate Planning 101: Consider These Do’s and Don’ts to Plan Ahead

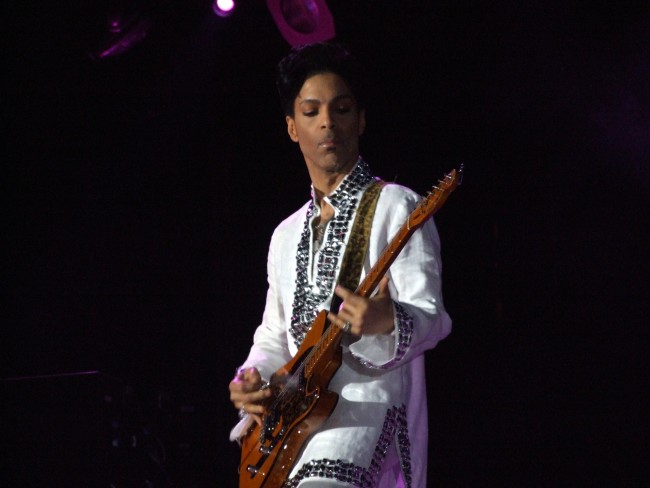

The untimely death of the rock star Prince has highlighted the complex issues involved when one dies without a will. His estate will now have to go through the probate process to determine how his assets will be distributed to his heirs, and how much estate tax will be owed. Complicating matters is determining the extent of his wealth. What value do you place on a rock legend’s rumored vault of unreleased material?

A sound estate plan can simplify a complex process for your heirs during a difficult time. Consider these points when planning the distribution of your estate:

Do

Create your estate plan as soon as you can. An estate plan is important for everyone, no matter your age or amount of assets and can protect you and your assets before you die. It can provide instructions for your care if you become mentally or physically incapacitated. Questions like how to pay for your care, who will care for family members, and whether you choose to have a Do Not Resuscitate (DNR) order for your care can be outlined in your estate plan.

Outlining your wishes is very important, because if someone is incapacitated by a stroke or other illness and has not named a guardian, the courts will take over management of the person’s care. An estate plan can outline contingencies for your care to avoid court participation. The estate plan will also help organize all your important records in one place, making it easier for your guardian or heirs to fulfill your wishes.

For this reason, we provide our clients with an Asset Inventory Binder that serves as a central location for all of their legal, health, insurance and of course financial documents.

Do

Review your estate plan regularly. Life changes can greatly alter your wishes for your estate plan. The birth of a child, divorce, or changes in investments are just a few reasons to update your estate plan. Even without major changes, a good rule of thumb is to review your estate plan every three to five years.

Don’t

Assume an estate plan will eliminate probate. In some cases, a part of your estate may be subject to the probate process, such as property owned by you without a named beneficiary, or a beneficiary that has pre-deceased you. Also, keep in mind that changing a beneficiary in your will does not change the beneficiary named on certain assets, such as a life insurance policy or investments like a 401(k). You will also need to change the beneficiary designation on each asset.

Do

Minimize the probate process with proper planning. There are many actions you can take in your estate plan to reduce the assets that must go through probate. Assets that have a named beneficiary will usually transfer without the need for probate. Setting up a revocable living trust is another way to transfer assets to a recipient, usually without going through probate.

Do

Seek expert guidance. You can’t take it with you, but you can leave a larger portion of your estate to your heirs with proper preparation. Planning your estate can be a complex process. Understanding terms like Durable Power of Attorney, Generation Skipping Transfer Tax, and Standalone Retirement Trust can be a daunting task. An estate planning attorney can help explain the more intricate details of an estate plan and discuss the best options for your situation.