Re-Assess Your Assets and Investments When Divorcing

While it’s not surprising anytime celebrities divorce, it’s never fun to watch. The tabloids will have a field day with the divorce proceedings for Angelina Jolie and Brad Pitt. Their fame, fortune, and family will make this a particularly difficult split, but the same is true for any couple going through divorce.

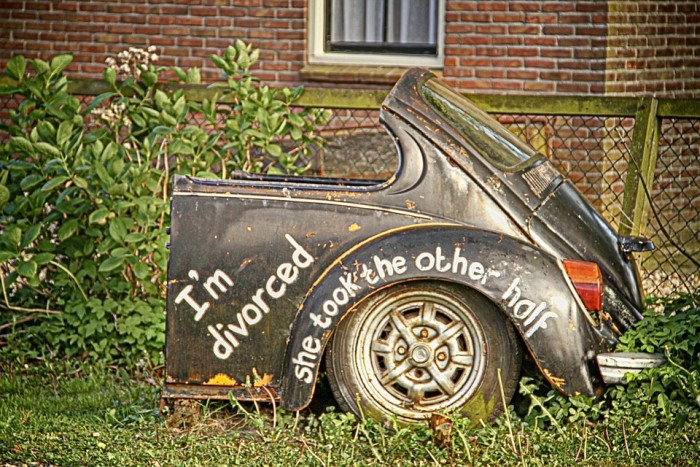

Division of assets during the divorce proceedings can be difficult and stressful, and if you’re not familiar with the extent of your holdings, it can be downright scary.

In addition to a divorce attorney, you may also want to work with a financial advisor to determine the best course of action for your settlement. They’ll be able to give you guidance and explain the many aspects of dividing your assets, including:

Splitting Retirement Funds

The component of your separation agreement that specifically addresses your retirement assets is known as a qualified domestic relations order (QDRO), or better known as “QWAD – RO”. A QDRO establishes that a spouse, ex-spouse, child, or other dependent is entitled to part of the proceeds from the retirement plan(s). A quick piece of advice – always be sure the division is based on percentages rather than dollar amounts. To learn why, see Divorce and Assets…50/50 Is Often Anything But. You’ll also want to re-visit the investment strategy for these retirement funds. Now that you’re alone, you may find you’re less risk-tolerant than the current allocation. That said, be leery of suggestions that you should take on more risk in an effort to make up for lost time.

Also, don’t forget about Social Security benefits. If your ex-spouse receives, or is schedule to receive, a greater amount of Social Security than you, you can elect to receive your monthly benefit based on that of you ex-spouse. In fact, you are entitled to up to 50% of your ex’s anticipated benefit. There are some caveats: you would need to have been married more than 10 years, not currently married, and 62 or older.

Who Gets the House?

While there’s typically a desire by one party to retain the home in an effort to maintain a sense of normalcy – especially when children are involved – be careful. While home equity is usually a significant component of the combined accumulated assets, remember it’s a phantom value. Anyone that endured a divorce at the height of the market in 2007 can attest to how quickly that equity evaporated in 2008. That said, be leery of attempts to utilize this intangible, and in most cases illiquid value, to offset your rightful claim to more tangible liquid assets such as stocks, bonds, or cash. While there are several options to consider, such as deferring the sale in hopes the value will increase, maintaining co-ownership and renting it out, or utilizing a short sale as a last resort, the two commonly used options are either to sell the property and divide the proceeds, or initiate a buy-out. However, should you desire to retain the home, remember that while it may be home sweet home, the cost of insurance, taxes, structural and yard maintenance should be considered as well.

Dealing with Debt

Divorce is not just a matter of splitting assets. You also have to take care of any outstanding debts the two of you may have. Ideally, your assets would cover any debts, but it usually doesn’t work out that way. A judge may choose to apportion debt based on the asset, such as the spouse who receives a car would be liable for the car loan. Credit card debts may be split as a whole, or each spouse may be assigned different credit cards to pay off. Debts, like assets, may not be divided equally. For instance, if your spouse gets more assets, the court may assign them more debt to balance it out.

The main point to remember is that you are not alone. Should you have questions or feel overwhelmed with the prospect of your divorce proceedings, don’t be afraid to seek assistance. Just as you sought the guidance of a skilled matrimonial attorney, you should now do so in similar fashion with a board Certified Financial Planner (CFP). As a matter of fact, the Wall Street Journal states that building your OWN team is key to your post divorce financial success. As someone who’s not only endured a divorce myself, but worked with countless others in this area as a financial advisor for almost 30 years, I couldn’t agree more. By doing so, you’ll position yourself for success as you proactively address the situation head-on, rather than reactively as a victim.

For more information, download our free guide: DIVORCE: Financial Mistakes To Avoid Before, During & After.