What a difference a year can make when taking income.

Should you be lucky enough to have strong returns during your retirement years, you may not experience any problems. However, if you have a series of modest, or negative returns while taking income from your IRA or 401(k) assets, the results could be catastrophic.

After a participant retires, the sequence of the returns they earn on their investments can have a major impact on how long their savings last. And remember that the impact of poorly-performing markets is increased when a participant takes regular withdrawals. They’re depleting their savings even faster.

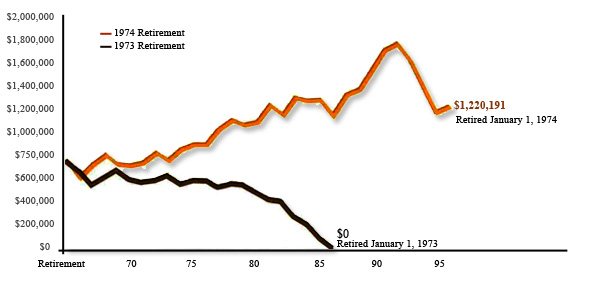

Let’s look at the example of Judy and Sam. Both begin their respective retirements with $750,000 and both withdraw 5% of that amount ($37,500) each year, indexed to inflation. Judy retired in 1973, while Sam retired in 1974. Judy, who began taking income during the 1973-74 bear market, ran out of savings after 21 years. Sam, who missed half of the bear market, was able to recover the losses. In fact, his savings grew over time.

Retirees don’t always have the option to stop making withdrawals during periods of market declines. Guaranteeing a source of income can help participants who retire in times of poor market returns.

Hypothetical – For illustrative purposes only. Does not account for taxes, product charges or fees that may affect outcome.

Our Solution

Unfortunately, in response to the items stated above, some advisors attempt to alleviate your concerns by utilizing market-based portfolio strategies that are generic in nature, – Conservative, Moderate, Aggressive, etc.

We utilize a different approach.

First – we insure your monthly income will be consistently in alignment with your expectations in the years ahead.

Second – we insure your assets are prudently invested with an eye toward mitigating risk, while achieving competitive returns – regardless of conditions.

The highly disciplined low risk, low volatility quantitative strategies we employ, are defined by a clear and simple philosophy – to help protect you from severe losses in down markets while maintaining the objective of quality participation in rising markets. This approach has resulted in reduced downside risk during negative markets. Affording you and your family a much more secure retirement income.

What steps have you or your Broker taken to protect against the next market drawdown? To preserve your income?

Whether it be providing a consistent retirement income through the use of an innovative distribution strategy, fostering stability in volatile markets as you near retirement, or striving to improve your net portfolio results through efficient tax-management – we go beyond the ordinary.

Should you wish to learn more – please call us directly at (800) 651-2930.